Ultrasound System Purchase Intent High on Anticipated Volume Shift from Other Modalities

Robust ultrasound equipment purchase intent is being driven by the anticipation of shifting procedure volumes to ultrasound from other imaging modalities, according to the recently published IMV 2023 Ultrasound Market Summary Report.

Looking at purchases planned from 2023-2026, 32% of sites are “planning” to purchase at least one type of ultrasound equipment and an additional 29% of sites are “maybe planning” a purchase. This yields a combined 61% of sites considering an ultrasound equipment purchase in the next several years.

The top two future outlook factors noted in the survey by ultrasound departments are, “Our current general ultrasound technology meets our clinical and throughput needs”, with 66% of respondents rating 4 or 5 out of 5, and “Our ultrasound procedures are increasing because some procedures are shifting from other imaging modalities”, with 48% of respondents rating a 4 or 5 out of 5. Indicating that the anticipated rise in ultrasound procedure volumes from other modalities is likely contributing to purchase intent.

The overall number of general ultrasound patient exams was down 2.3% from 38.5 million prior to the pandemic in 2019, to 37.6 million in 2022.

Among the three types of ultrasound systems specifically, cart-based, tablet/laptop and handheld, 68% of sites have one type, 28% of sites have two types and 4% of sites have all three types in their facility.

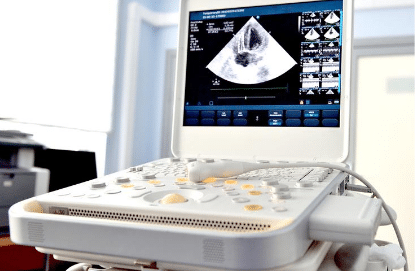

In terms of individual general ultrasound systems, 85% of units owned and managed by radiology departments are cart-based systems, 11% are laptop/tablet systems and 4% are handheld units. For cart-based ultrasound systems GE is present, having at least one unit, at 56% of sites, followed by Philips at 37%, Siemens at 18%, Canon at 15% and Samsung at 5%.

Inspecting the distribution of exams performed with each ultrasound equipment type, 95% of ultrasound exams are performed with cart-based systems, 5% with laptop/tablet systems and <1% with handheld systems.

Shifting to ultrasound department operations, as of the 2023 survey, overall there are 4.4 full-time equivalent (FTE) sonographers performing ultrasound exams per site.

Ultrasound will be an interesting modality to watch to see if the shift in procedure volumes from other modalities continues and to see how the different types of ultrasound systems are utilized in a clinical setting.

Want to share your knowledge of medical imaging? Click here to sign up for the IMV Survey panel today.

Davin Korstjens is a Senior Market Research Program Manager at IMV Medical Information Division, part of Science and Medicine Group.

IMV’s 2023 Ultrasound Market Summary Report explores market trends in U.S. hospitals including department priorities, future outlook, artificial intelligence trends, procedure volume, manufacture-installed base features and share, the use of OEM vs. third-party service providers, purchase plans, brand loyalty, and site operations characteristics. The report was published in July 2023 and is based on responses from 204 radiology/departmental administrators and clinicians who participated in IMV’s nationwide survey from February 2023 -April 2023. Vendors covered in this report include Butterfly Network, Canon, Clarius, Esaote, Fujifilm, GE, Healcerion, Hitachi, Konico Minolta, Mindray, Philips, Samsung, Siemens, and SonoScape.

For information about purchasing IMV Market Outlook Reports, visit the corporate website at https://imvinfo.com/ or call 703-778-3080 ext. 1033 to speak with a representative. In addition to the report, all purchases will include a complimentary recording of an executive summary presentation of findings conducted by IMV’s Senior Program Manager.

Disclosure: IMV Medical Information Division is a sister company of AuntMinnie.com.