Radiation therapy’s growth was mixed in 2022, with treatment visits declining 2.8% year-over-year but the number of treatment courses increasing by 2.9%, according to a new report published by IMV Medical Information Division.

But these particular data points in the report — called the IMV 2022-2023 Radiation Therapy Market Summary – reflect a gain in the efficiency of treating patients with radiation therapy, in part due as well to a 5.4% decrease in the average number of visits per course of treatment, report lead and IMV senior market research program manager Davin Korstjens said.

“The reduction in the number of radiation therapy treatment visits needed per course of treatment is a trend that we have seen continue over the past several years and shows meaningful progress toward improving the experience for patients undergoing treatments,” he told AuntMinnie.com.

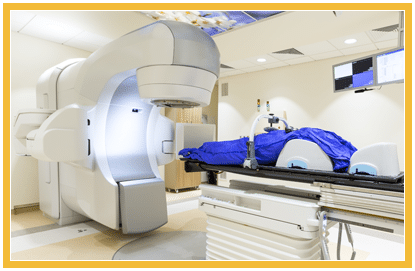

The report also found that, although the external beam radiation therapy installed base in the U.S. decreased by 3.3% in 2022, 50% of radiation therapy sites are considering the purchase of an EBRT system in the next three years, Korstjens said. In 2022, 40% of radiation therapy sites reported having brachytherapy units, and 15% of survey participants stated they are considering the purchase of a brachytherapy unit over the next three years.

Finally, in regards to image-guided radiation therapy equipment, 97% of sites that participated in the survey have this equipment installed, with the top three modalities being CT or cone beam CT, x-ray, and surface guidance radiation therapy.

“The gains in radiation therapy treatment efficiency seen so far are impressive and it will be interesting to continue to watch this metric to see where the trend will ultimately land,” Korstjens said.

Want to share your knowledge of medical imaging? Click here to sign up for the IMV Survey panel today.

Davin Korstjens is a Senior Market Research Program Manager at IMV Medical Information Division, part of Science and Medicine Group.

IMV’s 2022-2023 Radiation Therapy Market Summary Report explores market trends in U.S. hospitals and imaging centers, including procedure volume, manufacture-installed base features and share, the use of OEM vs. third-party service providers, purchase plans, brand loyalty, and site operations characteristics. The report was published in June 2023 and is based on responses from 312 radiology/departmental administrators and clinicians who participated in IMV’s nationwide survey from August 2021-April 2023. Vendors covered in this report include Accuray, Brainlab, Cerner, Elekta, Epic Varian, Elekta, Gammamed, GEHC, IBA, Nucletron, RaySearch, Siemens, Varian, View Ray, Vision RT and Xoft.

For information about purchasing IMV Market Outlook Reports, visit the corporate website at https://imvinfo.com/ or call 703-778-3080 ext. 1033 to speak with a representative. In addition to the report, all purchases will include a complimentary recording of an executive summary presentation of findings conducted by IMV’s Senior Program Manager.

Disclosure: IMV Medical Information Division is a sister company of AuntMinnie.com.