Description

Even before the COVID-19 pandemic, U.S. hospitals have been closely scrutinizing their capital and operating costs for imaging equipment. With continued pressure on their revenue sources, coverage for equipment maintenance, repair, and value-added services continue to be critical considerations in such budgetary decisions. As their use and deployment of imaging equipment continues to grow, hospitals and healthcare systems are seeking to consolidate and standardize their post-warranty service contracts across their imaging locations to decrease their operating costs, while gaining improved value for the support services they receive.

IMV’s 2020 Diagnostic Imaging Equipment Service Outlook Report provides insight into the types of post-warranty service arrangements used by U.S. hospitals for eleven key imaging modalities. This report quantifies the market shares of the imaging equipment manufacturers (OEMs) vs. third-party service providers, describes the use of different types of service contract arrangements by modality, the types of support services preferred, and identifies trends in priorities for future service contracts and preferred contract types. With the unprecedented COVID-19 pandemic having widespread impact nationwide, respondents were also asked what impact, if any, COVID-19 had on their need for equipment service, by modality.

Major imaging modalities covered in this report:

- CT scanners

- Fixed MRI scanners

- Fixed PET or PET/CT

- Fixed Nuclear Medicine cameras (SPECT/CT, SPECT-only, and planar-only units)

- Fixed C-arm systems used primarily for interventional and/or cardiac procedures (e.g., specials, angio labs, vascular labs, cath labs, hybrid OR)

- Portable C-arm units

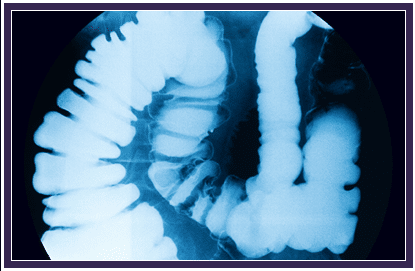

- Fixed Radiographic Fluoroscopy (RF) units (without fixed C-arms)

- Fixed General X-ray Radiography units (DR, CR, or analog)

- Mobile general x-ray units

- X-ray mammography units

- Ultrasound units

Questions answered by this report:

- What are the key department priorities for managing imaging equipment over the next few years?

- What is the estimated 2019-2021 market size of hospital service-related spending?

- How is this market split between contracts with OEMs vs. third-party service providers, as well as service purchased outside of contract coverage?

- What % of service budgets are spent by modality, including CT, MR, PET, NM, fixed & portable C-arms, RF, general x-ray, mammography, and ultrasound?

- What type of post-warranty service arrangements is preferred for each imaging modality, including full- service, shared-service, and multi-vendor contracts?

- What mix of OEM vs. third-party service providers are currently being utilized for each imaging modality?

- To what extent do existing service arrangements include value-added features such as on-site response time, remote diagnostics, and cybersecurity services?

- What types of service contract issues are priorities for hospitals to address over the next few years?

- What will be the preferred coverage types and support services for inclusion in future service contracts?

- Who are the key decision makers for service contract arrangements?