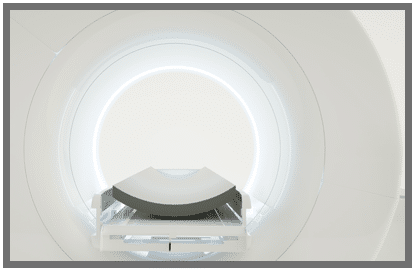

CT procedure volumes increased 9.1% from 2022 to 2023, according to IMV’s recently published 2023 CT Market Outlook Report. While both hospital and non-hospital CT procedure volumes increased, hospital volumes increased at 9.8% while, non-hospital volumes increased 6.4% year over year.

| Type | Change in CT Procedure Volumes |

| Overall | 9.1% |

| Hospital | 9.8% |

| Non-Hospital | 6.4% |

Looking ahead into 2024, 72% of CT sites surveyed anticipate that their 2024 CT procedures will increase compared to 2023, while 23% expect them to stay the same and just 1% of sites anticipate a decrease. One likely cause of the increase, with 60% of survey respondents rating 4 or 5 out of 5, is “Our CT procedures are increasing because some procedures are shifting from other imaging modalities to CT”.

Looking into the site operations needed to handle these increased volumes, on average CT sites have 7.1 CT technologists per site with a range of 16.8 in 400+ bed hospitals to a low of 3.2 in independent imaging centers.

Overall in 2023, an average of 2.2 CT technologists are involved with performing and preparing patients for CT exams on each scanner in their facility. This varies across sites as 34% of sites have one technologist performing these duties, 48% of sites have two, and a lower 17% of sites use three or more technologists to prepare patients for CT exams on each scanner.

| CT Technologists Performing and Prepping Patients for CT Exams | Percentage of Sites |

| 1 | 34% |

| 2 | 48% |

| 3 | 7% |

| 4+ | 10% |

CT procedure volumes have shown strong growth over the last few years and as volumes continue to increase the more efficient sites with available capacity are in the best position to realize the benefits from the increased volumes.

Want to share your knowledge of medical imaging? Click here to sign up for the IMV Survey panel today.

Davin Korstjens is a Senior Market Research Program Manager at IMV Medical Information Division, part of Science and Medicine Group.

IMV’s 2023 CT Market Outlook Report explores market trends related to service contracts for diagnostic imaging equipment in U.S. hospitals. The report was published in October 2023 and is based on responses from 313 radiology administrators and technicians who participated in IMV’s nationwide survey from July 2023 – August 2023. Vendors covered in this report include Bayer, Bracco, Canon, Fujifilm, GE Healthcare, Guerbet, Philips, Samsung, Siemens and United Imaging.

For information about purchasing IMV Market Outlook Reports, visit the corporate website at https://imvinfo.com/ or call 703-778-3080 ext. 1033 to speak with a representative. In addition to the report, all purchases will include a complimentary recording of an executive summary presentation of findings conducted by IMV’s Senior Program Manager.

Disclosure: IMV Medical Information Division is a sister company of AuntMinnie.com.